Ontario’s online gaming sector is on a roll, with the latest quarterly report from iGaming Ontario showing substantial increases across the board. The figures, covering the period from July to September 2024, reveal not only a growing appetite for online play but also a few standout trends across different gaming types.

Ontario poker, while demonstrating steady growth, has yet to catch up with the rapid expansion seen in online casino games, which once again set record highs.

Let’s take a closer look at how Ontario poker fared in Q2 2024-25 and where it stands in comparison to other gaming categories.

Ontario Poker Wagers and Revenue See Gains, But Growth Slows Relative to Casinos

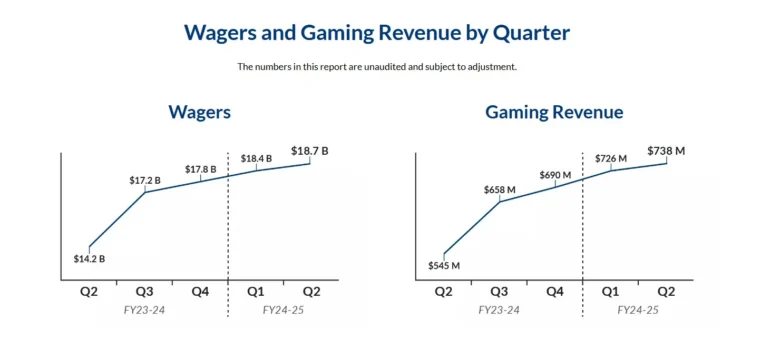

Ontario’s total online gaming wagers reached CAD $18.7 billion in Q2, a 1.6% increase from the previous quarter and a substantial 31.7% rise compared to the same period last year. This quarter-over-quarter growth reflects the continued expansion of Ontario’s regulated online market, driven by player interest across all gaming categories. Notably, this total excludes promotional wagers such as bonuses, underscoring the weight of direct player investment in the market.

Ontario’s total gaming revenue for Q2 2024-25 hit CAD $738 million, a 1.7% rise from Q1 and a 35.4% increase year-over-year. This revenue represents cash wagers across all operators, including fees from online poker rakes, tournament entries, and other gaming activities, minus player winnings but not factoring in operating costs or liabilities. The continued increase in gaming revenue points to strong player retention and rising engagement levels across the board.

However, while poker’s revenue climbed slightly, its year-over-year growth has not matched the staggering figures seen in Ontario’s casino sector. The slower pace suggests a loyal yet steady player base, with engagement primarily coming from dedicated players rather than a broad influx of new participants. This trend aligns with a growing sentiment in the industry. Ontario poker has potential, but tapping into a larger audience may require broader changes to the playing field.

Casino Games Dominate with $16 Billion in Wagers and $553 Million in Revenue

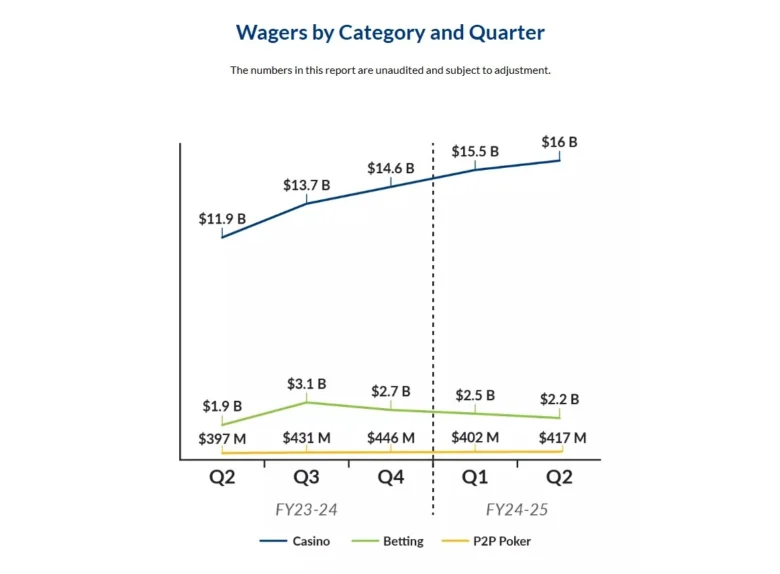

Casino games, which encompass slots, table games, and bingo, emerged as the clear leaders in Ontario’s online gaming market. Casinos accounted for $16 billion in total wagers, translating to 86% of all wagers for the quarter.

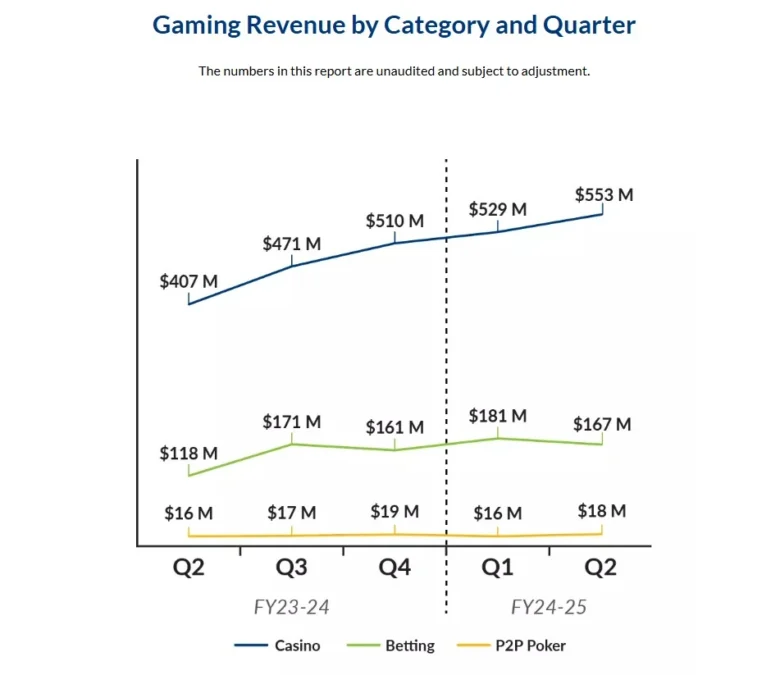

This segment’s CAD $553 million in revenue made up 75% of Ontario’s total gaming revenue, highlighting the category’s dominance. The surge in casino activity can be attributed to a combination of popular game offerings, player accessibility, and the consistent appeal of high-stakes casino games.

Compared to other categories, casino games have set record highs in both wagers and revenue, outpacing the growth seen in betting and poker. This trend suggests that Ontario’s online casino players are a significant driver of the province’s iGaming success.

Sports Betting Reaches $2.2 Billion in Wagers and $167 Million in Revenue

Ontario’s sports betting sector also performed well, with $2.2 billion in wagers this quarter, which made up 12% of total wagers in the province.

As seen from the graphs in the previous section, betting revenue for Q2 totaled $167 million, accounting for 23% of all gaming revenue. This category includes sports bets, e-sports, proposition bets, novelty bets, and exchange betting, and has shown steady growth as an alternative to traditional casino gaming.

The sector’s ability to maintain a stable share of the market indicates its ongoing popularity among Ontario’s online gaming audience.

Market Reach

In Q2, Ontario reported more than 1.32 million active player accounts across the province, a figure that includes accounts with cash and/or promotional wagers.

These numbers do not equate to unique players, as individuals may have accounts with multiple operators. The average monthly spend per active account was CAD $308, showing a healthy level of player commitment and spending in the market.

The Future of Ontario Online Poker

As Ontario’s online gaming market matures, all eyes are on the province to see how it might further expand and evolve, potentially through liquidity sharing or other strategic moves to enhance Ontario poker’s share.

Ontario poker may be a smaller part of the gaming market for now, but as iGO continues to release detailed reports, the future holds possibilities for growth and greater player engagement.